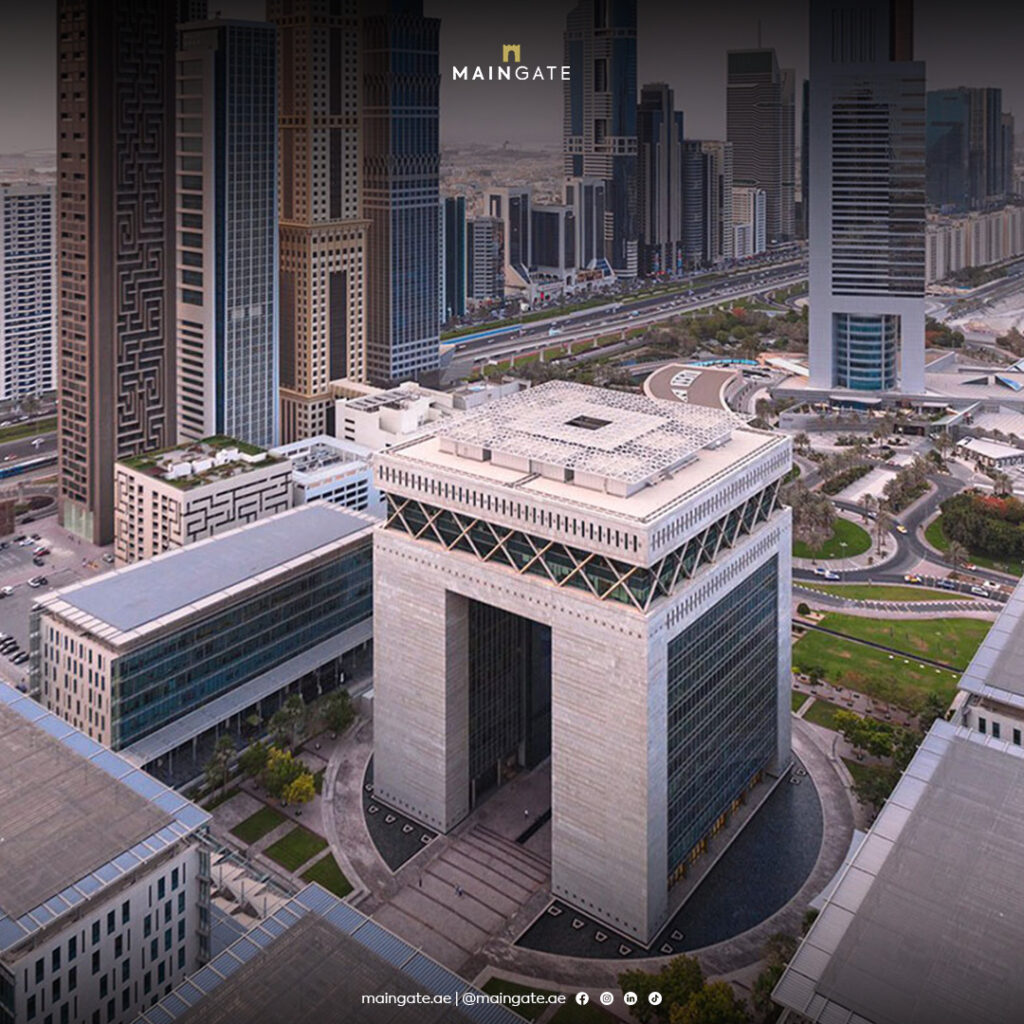

Established in 2004, the Dubai International Financial Centre (DIFC) spans across 110 hectares (272 acres) and serves as a specialized economic zone in Dubai. Its primary aim is to function as a financial nucleus for enterprises operating across the Middle East, Africa, and South Asia (MEASA) markets.

DIFC operates under the regulation of the Dubai Financial Services Authority, an autonomous regulatory body exclusive to the zone. Additionally, it boasts its own judicial system, the DIFC Courts, which operates independently from both Dubai’s legal framework and the federal government of the UAE. Functioning under the common law framework and conducting operations primarily in English, DIFC provides a conducive environment for financial activities.

As one of Dubai’s autonomous free zones, DIFC allows companies to enjoy complete ownership without the requirement of a local partner. Within its premises, DIFC accommodates financial institutions, wealth funds, as well as retail and hotel spaces designated for free zone activities.

One of the major attractions for businesses in DIFC is the assurance of a 50-year tax-free period on corporate income and profits, further supported by the UAE’s extensive network of double taxation treaties.

Recent reports from 2022 highlight a significant 19% annual surge in non-financial firms within DIFC, elevating the total count of international companies, family businesses, and corporate service providers to over 3,000.

Independent jurisdiction

The Dubai International Financial Centre (DIFC) stands as an independent jurisdiction within the constitutional framework of the United Arab Emirates (UAE). It operates with its own set of civil and commercial laws, distinct from those of the broader UAE, and maintains its own judicial system. Laws and regulations within the DIFC are drafted in English and default to English law in cases of ambiguity. The DIFC Courts comprise judges from various common law jurisdictions, such as England, Singapore, Hong Kong, and formerly Ireland. This independent jurisdiction of the DIFC encompasses various legal domains, including corporate, commercial, civil, employment, trusts, and securities law matters. However, it’s noteworthy that certain laws of the UAE or the Emirate of Dubai, such as criminal law and immigration regulations, remain applicable within the DIFC.

The DIFC-LCIA Arbitration Centre serves as an autonomous hub for international arbitration, employing rules inspired by those of the London Court of International Arbitration.

The DIFC Authority serves as the principal governing body of the DIFC, while the Dubai Financial Services Authority (DFSA) regulates financial services conduct within the DIFC. Notably, the DFSA operates independently from the federal Securities and Commodities Authority of the UAE, whose jurisdiction extends beyond the confines of the DIFC.

Recent events within the DIFC Court have drawn attention. In 2021, Lord (Angus) Glennie was sworn in as a judge in the presence of Sheikh Mohammed bin Rashid al-Maktoum. However, in July 2022, Lord Glennie faced criticism from retired barrister and former chair of Amnesty International Ireland, Bill Shipsey, for allegedly disregarding human rights abuses in the Emirates. This criticism followed the resignations of former Irish judges, including former Irish Chief Justice Frank Clarke and former President of the High Court Peter Kelly, who stepped down shortly after being sworn in at the DIFC Court amidst similar criticism from barrister and Labour Party leader Ivana Bacik.

Financial trading

Financial institutions in certain sectors can apply for licenses that come with attractive benefits: 0% tax on income and profits, 100% foreign ownership, unrestricted foreign exchange and capital/profit repatriation, operational support, and business continuity facilities.

At the heart of this financial hub lies a privately owned financial exchange. Originally established as the Dubai International Financial Exchange (DIFX) in September 2005, it underwent a rebranding in 2008 to become NASDAQ Dubai. Trading operates from 10:00 a.m. to 2:00 p.m. local time (6:00 a.m. to 10:00 a.m. GMT) Sunday through Thursday. Among the companies listed are DP World, which debuted with the largest initial public offering in the Middle East, raising $4.96 billion. This offering was oversubscribed 15 times, solidifying DP World as one of the most esteemed companies in the Middle East.

DIFC FinTech Hive

In April 2017, the DIFC unveiled its initiative aimed at fostering the growth of financial technology in the region. Arif Amiri, CEO of DIFC, expressed that the ‘FinTech Hive at DIFC’ would serve as a nexus connecting innovators in financial services technology with banks, financial institutions, and service providers within DIFC’s vibrant ecosystem. The initiative envisioned ten developers showcasing their products to venture capitalists. FinTech Middle East highlighted DIFC FinTech Hive’s pivotal role in the burgeoning financial technology market in the UAE, spotlighting emerging players like Bridg, Democrance, Beehive, among others. Notably, technology giants Facebook and Envestnet | Yodlee have also joined as partners.

On January 22, 2020, DIFC FinTech Hive rolled out a startup accelerator program named the ‘FinTech Hive Scale Up Programme’ for fintech startups across the Middle East, Africa, and South Asia (MEASA) region.

COMMUNITY OVERVIEW

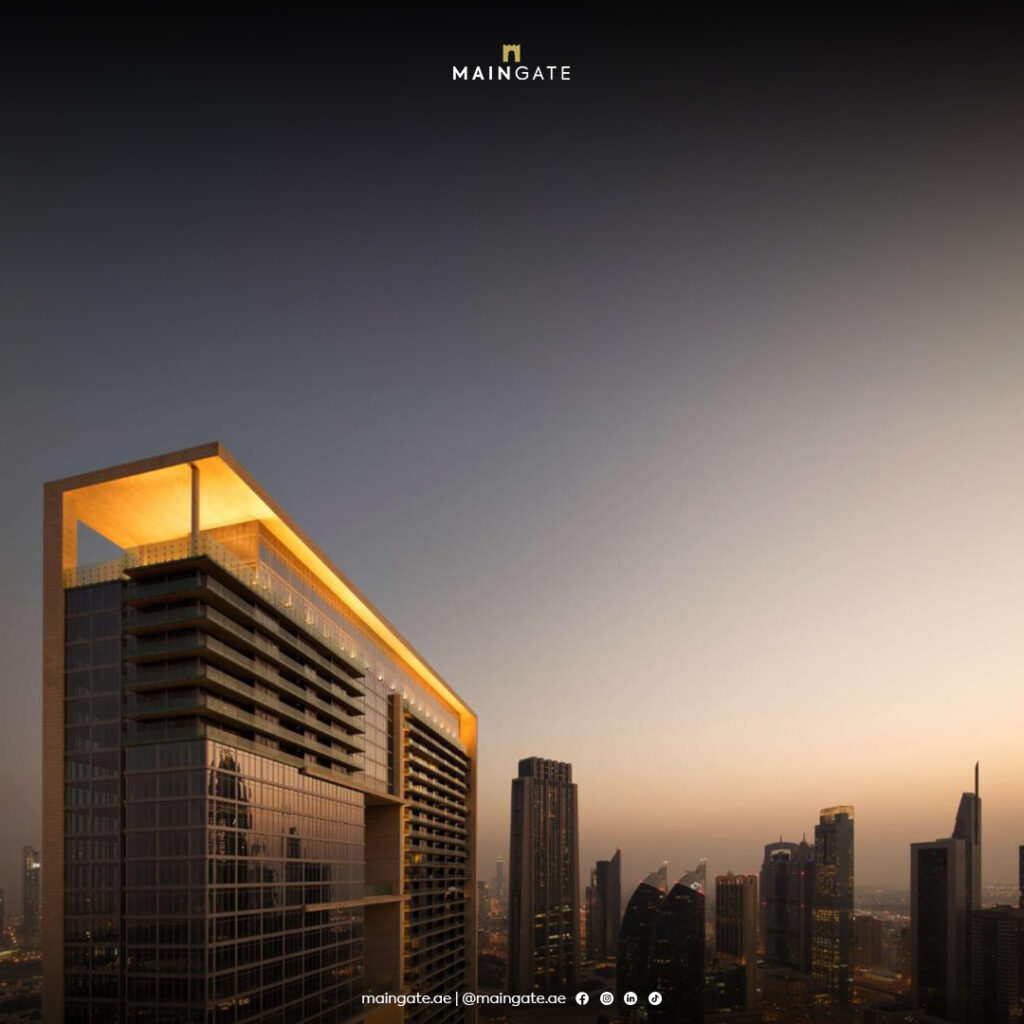

it offers a dynamic urban experience characterized by towering skyscrapers, a diverse array of retail and dining options, and modern amenities. Its vibrant atmosphere, punctuated by captivating art galleries and lively events, ensures that residents and visitors alike are engaged and entertained. The community’s strategic location, accessibility, and contemporary lifestyle make it particularly appealing to working professionals. DIFC’s business-friendly environment, supported by a comprehensive range of facilities and a regulated tax-free regime, common law framework, and judicial system, positions it as a premier destination for office rentals in Dubai. Whether you’re seeking small, mid-size, or large offices, shops, or residential properties, it offers a variety of options to suit your investment or relocation needs. Explore the diverse range of properties available and consider making DIFC your home or business base.

PROPERTIES

In DIFC, residential options cater to a diverse range of residents, from singles and couples to working professionals and families. These apartments, available for rent or sale, offer modern living spaces designed for world-class comfort and convenience. Towering buildings dominate the skyline, housing a variety of apartments, including studios, 1-3 bedroom units, and luxurious 4-5 bedroom penthouse suites.

Living in DIFC comes with the added advantage of proximity to Downtown Dubai, providing easy access to work, shopping, and leisure activities in this iconic neighborhood.

On the commercial front, DIFC boasts dedicated towers, complexes, and mixed-use projects. Retail spaces and shops can be found at the ground level of residential buildings or within dedicated office structures. To make an informed decision, explore price trends and popular projects within DIFC’s vibrant commercial real estate landscape.

RENTAL TRENDS

| Apartment Type | Average Rental Price in AED |

| Studio | 81,000 |

| 1-Bed | 134,000 |

| 2-Bed | 186,000 |

| 3-Bed | 212,000 |

SALES TRENDS

| Apartment Type | Average Rental Price in AED |

| Studio | 1,102,000 |

| 1-Bed | 1,809,000 |

| 2-Bed | 3,031,000 |

| 3-Bed | 4,425,000 |

HOTELS

DIFC’s upscale commercial landscape boasts several high-end hotels, each offering modern amenities and luxurious accommodations:

- The Ritz-Carlton, Dubai International Financial Centre: A prestigious 5-star hotel situated just off Sheikh Zayed Road, offering executive residences, fine dining options, a spa, and a club, providing guests with a five-star experience.

- Four Seasons Hotel DIFC: A boutique-style sanctuary featuring stunning city views from its glass-enclosed rooftop pool and offering modern suites equipped with all the amenities needed for a comfortable and relaxing stay. Guests can also enjoy cocktails at the Luna Sky Bar.

- Waldorf Astoria Hotel: A renowned luxury hospitality brand with a presence in various parts of Dubai, the Waldorf Astoria in DIFC is conveniently located near attractions like the Dubai Fountain and Burj Khalifa. It offers a range of upscale amenities and dining options, including The Artisan Il Ristorante, known for its exquisite Italian cuisine.

TRANSPORTATION AND PARKING SPACES IN DIFC

Given its status as a bustling commercial center, traffic congestion in DIFC is not uncommon, particularly during peak hours. Planning your commute to and from the area with some flexibility in timing can help navigate this.

For residents, most complexes provide dedicated parking spaces. However, visitors may encounter challenges in finding public parking outdoors, with rates typically around AED 10 per hour.

Public transportation options in DIFC are convenient and accessible. The area is within walking distance of two metro stations: Emirates Towers and Financial Centre. Additionally, there are several bus lines serving the area and nearby locations. While taxis are plentiful, securing one during rush hour may pose difficulties due to high demand.

AMENITIES, SCHOOLS AND HEALTHCARE

DIFC offers a comprehensive range of amenities to ensure residents’ convenience and comfort, from supermarkets to places of worship, recreational facilities, and top-notch family restaurants.

For grocery shopping, several supermarkets are conveniently located within DIFC, making regular shopping hassle-free. These supermarkets are typically situated on the ground floors of various buildings within the community. Popular options include Spinneys Supermarket, BS Supermarket LLC, Fresh Mart Supermarket, Choithrams, and Al Maya Supermarket. Spinneys, a favored choice for monthly grocery hauls, has multiple outlets in Dubai, including one in Central Park Towers, open seven days a week for residents’ convenience.